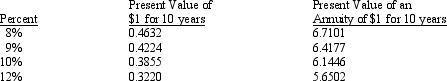

An asset is purchased for $100,000. It is expected to provide an additional $14,800 of annual net cash inflows. The asset has a 10-year life and an expected salvage value of $6,000. The hurdle rate is 9%. Assume the following present value factors:  Given the data provided, the net present value would be approximately:

Given the data provided, the net present value would be approximately:

Definitions:

Mutual Fund

An investment vehicle made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, and other assets.

Financial Market

Platforms or systems where financial instruments like stocks, bonds, currencies, and derivatives are bought and sold.

Bonds

Fixed-income securities that represent a loan made by an investor to a borrower, typically used by corporations, municipalities, states, and governments to finance projects and operations.

Stock Exchange

A stock exchange is a marketplace where securities, such as stocks and bonds, are bought and sold, facilitating capital exchange between investors and companies.

Q20: Creasly Company has an economic order quantity

Q27: Hannafin Company decreased the size of inventory

Q27: Refer to Exhibit 21-7. Line C on

Q29: A performance measurement system that emphasizes the

Q41: Which of the following activities would be

Q69: Exhibit 20-4 The Hanover Catalog Company has

Q92: Which of the following is NOT an

Q100: Which of the following types of accounts

Q104: Revenues cause<br>A) An increase in net assets<br>B)

Q112: Assume the following facts for Erich Company: