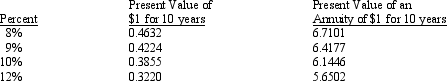

An asset is purchased for $100,000. It is expected to provide an additional $15,600 of annual net cash inflows. The asset has a 10-year life and no expected salvage value. The hurdle rate is 10%. Assume the following present value factors:  Given the data provided, the internal rate of return would be approximately:

Given the data provided, the internal rate of return would be approximately:

Definitions:

Well-Organized Markets

Refers to financial markets that are structured efficiently, facilitating the seamless exchange of securities.

Dollar Return

The total gain or loss on an investment expressed in monetary terms, considering both capital gains and dividends or interest.

Shares

Portions of ownership in a corporation or financial entity, shares guarantee an equal share in dividend payouts, contingent on profit declarations.

Dividend

A share of a company's profits distributed to its shareholders, often expressed as a dollar amount per share.

Q2: Everclean Company cleans draperies. It charges $90

Q3: The basic accounting equation<br>A) Is out of

Q5: Which of the following qualitative factors should

Q14: Which of the following is NOT a

Q16: The basic accounting equation is<br>A) Assets =

Q40: Block Company sells three products, each with

Q50: The internal control structure of a company

Q83: The internal rate of return and the

Q86: Parkways Inc. is considering the purchase of

Q106: Marbletop, Inc. had the following transactions during