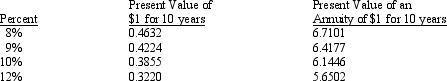

An asset is purchased for $100,000. It is expected to provide an additional $14,800 of annual net cash inflows. The asset has a 10-year life and an expected salvage value of $6,000. The hurdle rate is 9%. Assume the following present value factors:  Given the data provided, the net present value would be approximately:

Given the data provided, the net present value would be approximately:

Definitions:

Preparedness

The concept that certain associations are learned more readily than others due to evolutionary predispositions.

Food Aversion

A strong dislike or disinclination towards a specific food, often resulting from a negative past experience such as illness.

Behavior Modification

A therapeutic approach designed to change specific undesirable behaviors using reinforcement principles.

Classical Conditioning

The method of instruction where a response is learned by associating a stimulus from the environment with one that occurs naturally.

Q11: Earnings management through deceptive accounting is best

Q29: Brooklynne Company paid $25,400 in insurance premiums

Q35: If the tax rate is 40% and

Q36: At a break-even point of 600 units

Q40: In a make-or-buy decision, management would consider:<br>A)

Q50: The capital stock account is<br>A) Increased with

Q50: Costs that can be eliminated in whole

Q88: If a decision regarding special orders is

Q100: The following are summary financial data of

Q127: Given the following information, draw a profit