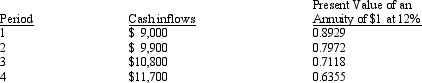

Stanley Company invested in an asset with a useful life of 4 years and no salvage value. The company's expected rate of return is 12%. The cash inflows and present value factors for 4 years are as follows:  If the asset generates a positive net present value of $3,000, what was the amount of the original investment?

If the asset generates a positive net present value of $3,000, what was the amount of the original investment?

Definitions:

Operating Expense Fee

Fees charged by mutual funds and investment companies for the cost of managing the fund, including administrative and management services.

Front-End Load Fee

A charge applied at the time of purchase of an investment, typically pertaining to mutual funds.

12b-1 Fee

A fee that mutual funds may charge for marketing, distribution, and service expenses, expressed as a percentage of assets under management.

Net Asset Value

The value per share of a fund, calculated by dividing the total value of the fund's assets minus its liabilities by the number of shares outstanding.

Q1: Which of these factors is necessary to

Q14: For which decision(s) would shipping costs be

Q18: Refer to Exhibit 2-3. Given the above

Q41: An example of a leading performance measure

Q42: Which of the following accounts is considered

Q62: Plumas Company presently has two products: tapes

Q77: CharCore mixes together wood chips and pine

Q78: Which of the following is NOT included

Q79: Which of the following is generally considered

Q98: Which of the following types of entries