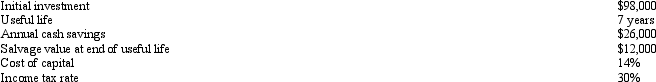

Speedy Movers is considering the purchase of a new moving truck that will reduce fuel and maintenance costs as well as increase revenues. Data related to the new truck follows:

Assume all cash flows occur at the end of the year and the company will depreciate the truck using straight-line depreciation. Calculate the net present value of the truck. Should the company purchase the new truck? Explain your answer.

Assume all cash flows occur at the end of the year and the company will depreciate the truck using straight-line depreciation. Calculate the net present value of the truck. Should the company purchase the new truck? Explain your answer.

Definitions:

Cash Flows

The total amount of money being transferred into and out of a business, particularly in terms of operational, investment, and financing activities.

Interest Rate

The percentage of a sum of money charged for its use, typically expressed as an annual percentage rate.

Interest Rate

The percentage of a loan amount charged by lenders to borrowers for the use of money, or the rate earned on deposit accounts.

Net Present Value

A method used in capital budgeting to analyze the profitability of an investment by calculating the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Q11: Refer to Exhibit 21-1. Using the graph

Q26: Excessive earnings management typically begins as a

Q50: The internal control structure of a company

Q52: Northwest Company presently has two products: compasses

Q63: The report which highlights variances from budget

Q68: Refer to Exhibit 21-6. In the graph

Q72: A collection of an account receivable was

Q86: On January 25, Blayne Corporation bought

Q102: According to Sarbanes-Oxley, which one of the

Q118: Responsibility accounting is used in:<br>A) Cost centers<br>B)