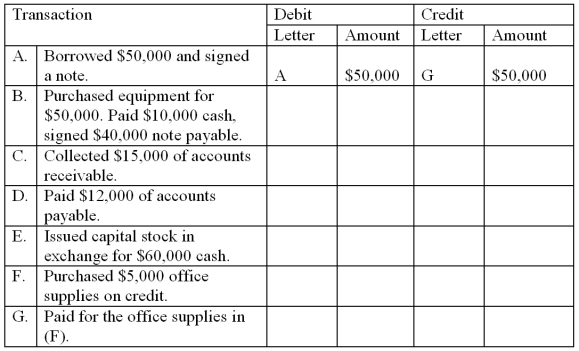

The accounts with identification letters for Ward Company are listed below. During 2010,the company completed the transactions given below.You are to indicate the appropriate journal entry for each transaction by giving the account letter and amount.Some entries may need three letters.The first transaction is given as an example.

Definitions:

Overtime Pay

Additional compensation provided to employees for hours worked beyond their standard working hours.

Federal and State Income Tax

Taxes imposed by the federal and state governments on taxable income earned by individuals and corporations.

Federal Insurance Contributions Act

A U.S. law that mandates a payroll tax on the paychecks of employees, as well as contributions from employers, to fund the Social Security and Medicare programs.

Cumulative Gross Earnings

The total gross income earned by an individual or entity before any deductions over a given period.

Q11: Fulton Company was established at the beginning

Q53: Chad Jones is the sole owner and

Q57: A number of factors influence the sample

Q62: How is net income in the income

Q69: Which of the following is not true

Q84: Which of the following accounts normally have

Q85: Under the Single Audit Act of 1984,CPAs

Q87: Many valuable assets such as trademarks and

Q107: During 2010,Sigma Company earned service revenues amounting

Q108: The following information has been provided by