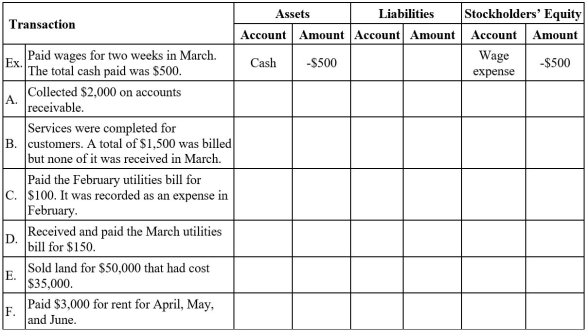

Part A.Perform transaction analysis for Blake Company regarding the following transactions for the month of March.Indicate the account affected by the transaction as well as the increase (+)or decrease (-)to the components of the accounting equation and the amount.  Part B.Determine whether the transactions A-F above affected cash flows during March.If so,determine the type of activity as an operating activity,an investing activity,or a financing activity.If cash is not affected use "no effect." Place an X under the appropriate column for each transaction.

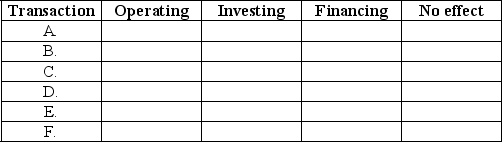

Part B.Determine whether the transactions A-F above affected cash flows during March.If so,determine the type of activity as an operating activity,an investing activity,or a financing activity.If cash is not affected use "no effect." Place an X under the appropriate column for each transaction.

Type of Activity

Definitions:

Sales Tax

A consumption tax imposed by the government on sales of goods and services, collected by retailers at the point of sale and passed on to the government.

Cash Register

An electronic or mechanical device for registering and calculating transactions at a point of sale, often equipped with a cash drawer.

Cashier's Accuracy

The measure of a cashier's performance in handling transactions correctly, minimizing discrepancies between the recorded amount and the actual amount of cash received.

Internal Control

Initiatives and practices instituted by an enterprise to confirm the trustworthiness of its financial and accounting statements, uphold responsibility, and eliminate fraud.

Q5: The primary difference between revenues and gains

Q18: Passive debt investments other than held-to-maturity investments

Q19: The cost of not taking a 2/10,

Q41: The following income statement was reported for

Q58: Ambrin Corp. expects to receive $2,000 per

Q65: Why is the CPA's role in performing

Q66: Which of the following journal entries correctly

Q92: The essence of reporting the gains on

Q103: Which of the following is not an

Q114: Which of the following transactions would be