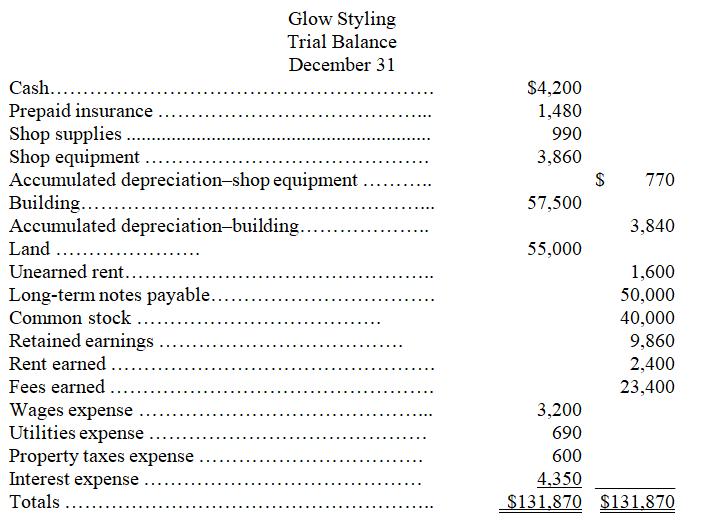

Based on the unadjusted trial balance for Glow Styling and the adjusting information given below,prepare the adjusting journal entries for Glow Styling.After completing the adjusting entries,prepare the trial balance for Glow Styling.

Glow Styling unadjusted trial balance for the current year follows: Additional information:

Additional information:

a.An insurance policy examination showed $1,240 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,220.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was earned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Use the above information to prepare the adjusted trial balance for Glow Styling.

Definitions:

Convergence of Data

The process where multiple pieces of data, often from different sources or methodologies, come together to support a cohesive conclusion or finding.

Intensive Single-Subject

A research methodology that focuses deeply on a single subject, exploring aspects or phenomena in great detail.

Quantitative Design

A research strategy that focuses on quantifying the collection and analysis of data.

Standardization

The process of making something conform to a standard in order to ensure consistency and comparability across different instances or measurements.

Q7: Which of the following statements regarding inventory

Q64: Following is the year-end adjusted trial balance

Q149: Asset accounts are decreased by debits.

Q151: The Income Summary account is used to:<br>A)Adjust

Q219: The main purpose of adjusting entries is

Q222: A bookkeeper has debited an asset account

Q229: If the Balance Sheet and Statement of

Q235: A company reported the following information for

Q241: Errors made in journalizing transactions,posting to the

Q274: _ are required at the end of