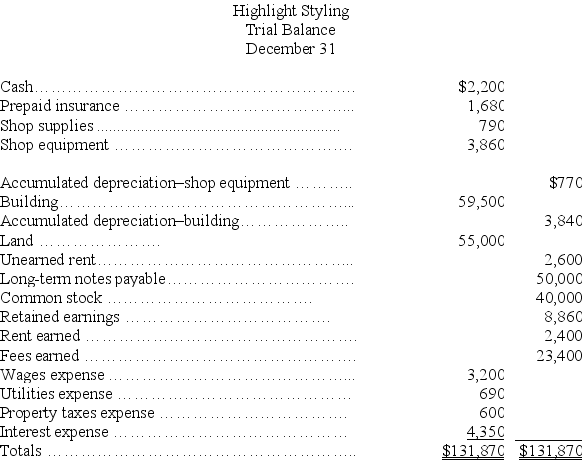

Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

Highlight Stylings' for the current year follows:

Additional information:

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Definitions:

Innovation

The process of creating new products, services, or methods that improve efficiency or provide new benefits.

Distribution Method

Strategies and channels a company uses to deliver its goods or services to consumers.

Inverted-U Theory

A hypothesis suggesting that income inequality will rise and then fall over the course of economic development, forming an inverted U-shape curve.

R&D Expenditures

Funds allocated by companies, institutions, or governments towards research and development activities to innovate or improve products, services, or processes.

Q9: The monetary unit assumption:<br>A)Means that accounting information

Q83: Karl Company accrued wages of $7,350 that

Q102: A company made no adjusting entry for

Q114: Profit margin is defined as:<br>A)Revenues divided by

Q139: A company reported the following information for

Q167: On August 31 of the current year,the

Q188: If equity is $300,000 and liabilities are

Q222: A bookkeeper has debited an asset account

Q242: Identify the accounts that would normally have

Q316: Which of the following statements is incorrect?<br>A)Adjustments