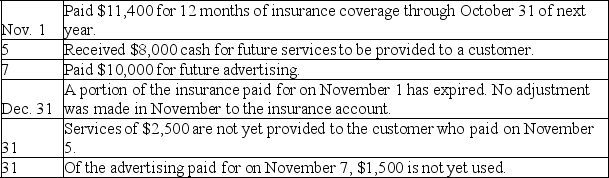

Gracio Co.had the following transactions in the last two months of its year ended December 31.Prepare entries for these transactions under the method that records prepaid expenses as expenses and records unearned revenues as revenues.Also prepare adjusting entries at the end of the year.

Definitions:

Journal

A comprehensive listing documenting all monetary transactions of a company, first noted before being moved to the general ledger accounts.

Ledger Accounts

Individual financial records within the ledger that capture all transactions related to a specific asset, liability, equity, revenue, or expense.

Recording Process

The systematic method of capturing, documenting, and maintaining financial transactions and events in the accounting records of an organization.

Ledger Accounts

Individual accounts within the ledger that record transactions related to a company's assets, liabilities, equity, revenue, and expenses.

Q60: The debt ratio is used:<br>A)To measure the

Q81: GreenLawn Co.provides landscaping services to clients.On May

Q148: If Tyrol Willow,the sole stockholder of Willow

Q172: If a company mistakenly forgot to record

Q197: Accrual accounting and the adjusting process rely

Q210: Debit means increase and credit means decrease

Q250: Define inventory for a merchandising company and

Q253: In accrual accounting,accrued revenues are recorded as

Q365: Net income for a period will be

Q396: On December 1,Orenthal Marketing Company received $3,600