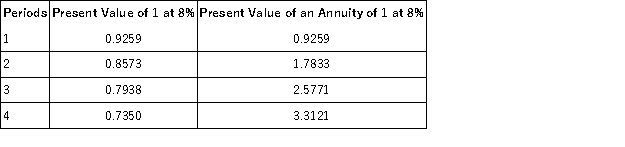

The following present value factors are provided for use in this problem.  Cliff Co.wants to purchase a machine for $40,000,but needs to earn an 8% return.The expected year-end net cash flows are $12,000 in each of the first three years,and $16,000 in the fourth year.What is the machine's net present value (round to the nearest whole dollar) ?

Cliff Co.wants to purchase a machine for $40,000,but needs to earn an 8% return.The expected year-end net cash flows are $12,000 in each of the first three years,and $16,000 in the fourth year.What is the machine's net present value (round to the nearest whole dollar) ?

Definitions:

Service Cost

The actuarial present value of benefits earned by employees in the current period under a defined benefit plan, included in pension expense.

Interest Cost

The cost incurred by an entity for borrowing funds, typically reflected as an expense in the income statement.

Pension Expense

The annual cost recognized by an employer for maintaining a retirement plan for its employees.

Actuarial Assumptions

Estimates used to calculate the present and future financial obligations of pension plans and insurance policies, often involving life expectancy and interest rates.

Q1: Which of the following factors is NOT

Q13: Which of these is not important to

Q21: How does a life course perspective of

Q26: Which of the following was a central

Q32: When we adjust for health status, the

Q35: A quantity of inventory that provides protection

Q38: The following information describes a company's usage

Q96: A rolling budget is a specific budget

Q99: In regard to joint cost allocation,the "split-off

Q164: LJ Co.produces picture frames.It takes 3 hours