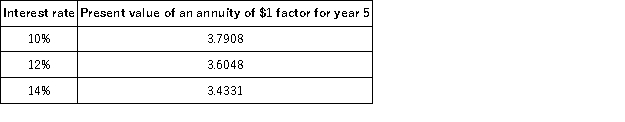

Tressor Company is considering a 5-year project.The company plans to invest $90,000 now and it forecasts cash flows for each year of $27,000.The company requires that investments yield a discount rate of at least 14%.Selected factors for a present value of an annuity of 1 for five years are shown below:  Calculate the internal rate of return to determine whether it should accept this project.

Calculate the internal rate of return to determine whether it should accept this project.

Definitions:

Empty Nest

Transitional phase of parenting following the last child’s leaving the parents’ home.

Deindividuation

A psychological state where an individual loses their sense of self-awareness and feels less accountable for their actions, often in group settings.

Identity Accommodation

Whitbourne’s term for adjusting the self-concept to fit new experience.

Gray Hairs

Hair that has lost its natural color, typically as a result of aging, turning to a shade of gray or white.

Q1: Health is generally considered to be a

Q2: Paxton Company can produce a component of

Q7: If actual price per unit of materials

Q7: According to the text, which of the

Q11: Persistent differences in disease and mortality rates

Q17: Clevenger Co.planned to produce and sell 30,000

Q17: Objects lacking in any religious or transcendent

Q19: According to the 2003 Canadian Community Health

Q74: A(n)_ arises from a past decision and

Q75: Flamingos,Inc.has four departments.The Administrative Department costs are