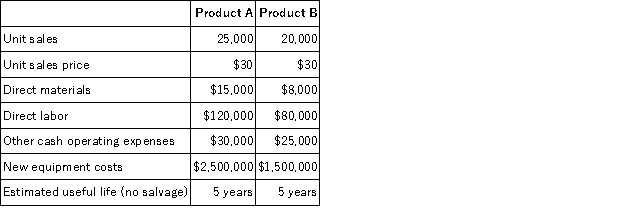

A company is trying to decide which of two new product lines to introduce in the coming year.The company requires a 12% return on investment.The predicted revenue and cost data for each product line follows:  The company has a 30% tax rate and it uses the straight-line depreciation method.The present value of an annuity of 1 for 5 years at 12% is 3.6048.Compute the net present value for each piece of equipment under each of the two product lines.Which,if either of these two investments is acceptable?

The company has a 30% tax rate and it uses the straight-line depreciation method.The present value of an annuity of 1 for 5 years at 12% is 3.6048.Compute the net present value for each piece of equipment under each of the two product lines.Which,if either of these two investments is acceptable?

Definitions:

Securities Act of 1933

A U.S. federal law, also known as the "truth in securities" law, which requires that investors receive financial and other significant information concerning securities being offered for public sale.

Qualified Opinions

In the context of auditing, these are statements made by an auditor expressing certain reservations about the financial health or the bookkeeping practices of a firm while generally certifying the financial statements as accurate.

Disclaimers of Opinions

Statements that limit or reject responsibility for the accuracy or completeness of information, often used in legal documents and reports.

Unaudited Financial Statements

Financial reports that have not undergone a formal examination by an independent certified public accountant or auditing firm.

Q3: Medicalization of expectation is a component of:<br>A)

Q10: Which of the following is NOT one

Q15: The term Food Deserts refers to:<br>A) The

Q18: Larger,more complex organizations usually require a longer

Q19: According to the 2003 Canadian Community Health

Q40: Based on a predicted level of production

Q67: The usual starting point for preparing a

Q67: Minor Electric has received a special one-time

Q132: The potential benefits lost by taking a

Q155: Job #411 was budgeted to require 3.5