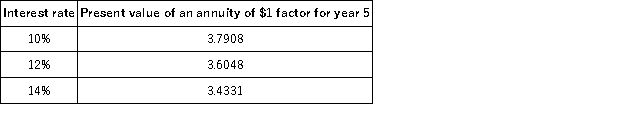

A company is considering a 5-year project.The company plans to invest $60,000 now and it forecasts cash flows for each year of $16,200.The company requires a hurdle rate of 12%.Calculate the internal rate of return to determine whether it should accept this project.Selected factors for a present value of an annuity of 1 for five years are shown below:

Definitions:

Q3: Which of the following statements is the

Q5: Discuss the potential effects of a social

Q25: Power is a key component in which

Q26: If a company has the capacity to

Q29: Which of the listed models of primary

Q82: If budgeted beginning inventory is $8,300,budgeted ending

Q118: Parallel Enterprises has collected the following data

Q145: Capital budgeting decisions are risky because the

Q154: Bengal Co.provides the following sales forecast for

Q155: The following is a partially completed lower