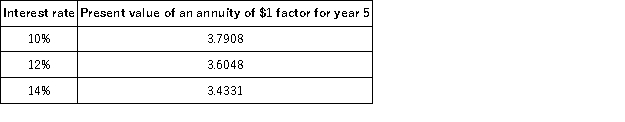

Tressor Company is considering a 5-year project.The company plans to invest $90,000 now and it forecasts cash flows for each year of $27,000.The company requires that investments yield a discount rate of at least 14%.Selected factors for a present value of an annuity of 1 for five years are shown below:  Calculate the internal rate of return to determine whether it should accept this project.

Calculate the internal rate of return to determine whether it should accept this project.

Definitions:

Overweight

A condition characterized by having more body fat than is optimally healthy, which can precede obesity.

Organized Sports

Structured athletic activities that are governed by rules and often involve teams or individual competitors.

Gray Matter

Refers to the darker-colored regions of the brain and spinal cord, primarily made up of nerve cell bodies and branching dendrites, involved in muscle control and sensory perception such as seeing and hearing.

Intelligence Scores

Numerical measures obtained from cognitive tests aimed at assessing an individual's mental capacity and abilities compared to an average score.

Q9: The shift from the second to third

Q11: Canfield Technical School allocates administrative costs to

Q14: A flexible budget is based on a

Q20: Which of the following is one of

Q54: When standard manufacturing costs are recorded in

Q60: When computing a price variance,the price is

Q81: Anniston Co.planned to produce and sell 40,000

Q112: Minor Electric has received a special one-time

Q121: The type of department that generates revenues

Q176: Southland Company is preparing a cash budget