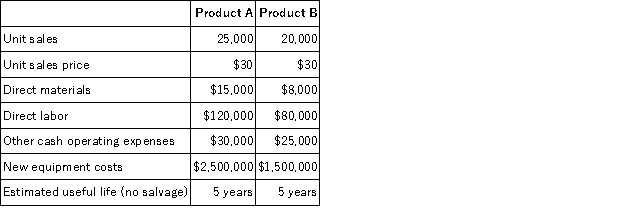

A company is trying to decide which of two new product lines to introduce in the coming year.The company requires a 12% return on investment.The predicted revenue and cost data for each product line follows:  The company has a 30% tax rate and it uses the straight-line depreciation method.The present value of an annuity of 1 for 5 years at 12% is 3.6048.Compute the net present value for each piece of equipment under each of the two product lines.Which,if either of these two investments is acceptable?

The company has a 30% tax rate and it uses the straight-line depreciation method.The present value of an annuity of 1 for 5 years at 12% is 3.6048.Compute the net present value for each piece of equipment under each of the two product lines.Which,if either of these two investments is acceptable?

Definitions:

Marginal Cost

The change in total cost that arises when the quantity produced is incremented by one unit; essentially, it is the cost of producing one more unit of a good.

Output

The quantity of goods or services produced by a firm or economy.

Total Revenue Curve

A graphical representation that shows how total revenue changes as the quantity sold of a good or service changes, holding all other factors constant.

Marginal Revenue

The increase in revenue that results from the sale of one additional unit of output.

Q2: Paxton Company can produce a component of

Q11: Persistent differences in disease and mortality rates

Q17: The Royal Commission on the Future of

Q18: According to the textbook, the aging of

Q32: Watson Corporation is considering buying a machine

Q60: The accounting rate of return is calculated

Q85: A company's flexible budget for the range

Q105: Flagstaff Company has budgeted production units of

Q107: A management approach that focuses attention on

Q140: Pepper Department store allocates its service department