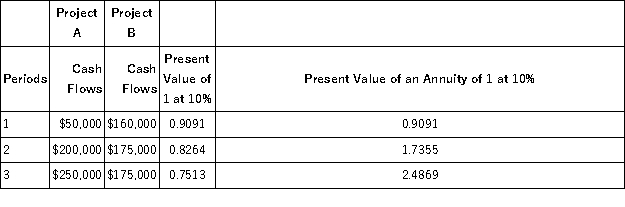

Trevoline Company is deciding between two projects.Each project requires an initial investment of $350,000.The projected net cash flows for the two projects are listed below.The revenue is to be received at the end of each year.Trevoline requires a 10% return on its investments.The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below.Use net present value to determine which project should be pursued and explain why.

Definitions:

Alkaloid

A group of naturally occurring chemical compounds that mostly contain basic nitrogen atoms, found in plants and are often used for their medicinal properties.

Anticancer Agent

A substance that inhibits or prevents the growth of cancer cells, often used in chemotherapy and medical treatment of cancer.

J. Med. Chem.

Short for Journal of Medicinal Chemistry, a scientific journal publishing research on the design and chemical properties of therapeutic agents.

Acetyl Chloride

A reactive organic compound used as a reagent in organic synthesis, characterized by an acetyl group bonded to a chloride.

Q7: If actual price per unit of materials

Q7: Which of the following is NOT one

Q10: The influence of the biomedical model still

Q20: Which of the following cash flows is

Q93: An overhead cost variance is the difference

Q100: The merchandise purchases budget is the starting

Q106: In sales variance analysis,the budgeted amount of

Q134: The anticipated costs incurred under normal conditions

Q139: Porter Co.is analyzing two projects for the

Q139: The difference between the flexible budget sales