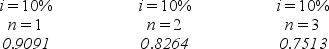

A project requires a $28,500 investment and is expected to generate end-of-period annual cash inflows of $12,000 for each of three years.Assuming a discount rate of 10%,what is the net present value of this investment? Selected present value factors for a single sum are shown in the table below:

Definitions:

Succeeding Fiscal Years

The periods following the current fiscal year, typically referring to future financial or budgetary planning years.

Lessor's Implicit Rate

The interest rate a lessor effectively charges a lessee in a lease agreement, often used to calculate the present value of minimum lease payments.

Incremental Borrowing Rate

The interest rate a company would have to pay if it borrows funds to finance a lease or purchase of an asset.

Discount

A reduction from the usual cost of something, often applied to incentivize purchase.

Q7: A _ journal is used to record

Q14: The accounting rate of return uses cash

Q43: Explain the concept of the future value

Q79: A company paid $47,500 plus a broker's

Q83: Parris Corporation purchased 40% of Samitz Corporation

Q87: The expected amount of time to recover

Q98: A company purchased $60,000 of 5% bonds

Q115: Doherty Corporation had net income of $30,000,net

Q151: Carter Company reported the following financial numbers

Q154: At acquisition,debt securities are:<br>A)Recorded at their cost,plus