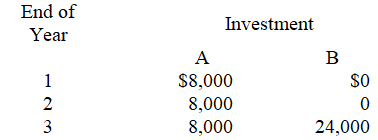

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments.The company is considering two different investments.Each require an initial investment of $15,000 and will produce cash flows as follows:

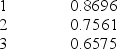

The present value factors of $1 each year at 15% are:

The present value of an annuity of $1 for 3 years at 15% is 2.2832

-The net present value of Investment A is:

Definitions:

1970s

A decade characterized by significant social, political, and technological changes, marked by events such as the Vietnam War, the Watergate scandal, and the advent of personal computing.

Family Therapy

A form of psychotherapy that aims to reduce distress and conflict by improving the systems of interactions between family members.

Eating Disorders

Mental disorders that involve serious disturbances in eating behavior, such as anorexia nervosa and bulimia nervosa.

Adolescents

Individuals in the transitional stage of physical and psychological development that generally occurs during the period from puberty to legal adulthood (age of maturity).

Q55: Consolidated financial statements:<br>A)Show the results of operations,cash

Q58: Ahngram Corp.has 1,000 carton of oranges that

Q59: The annual average investment amount used to

Q72: A company produces three different products that

Q89: A company manufactures two products.Each unit of

Q97: While companies strive to achieve ideal standards,reality

Q105: Unrealized gains and losses on trading securities

Q123: Dragoo Building Inc.has a crane with a

Q125: In closing the accounts at the end

Q160: On January 1,2011,Posten Company purchased 10,000 shares