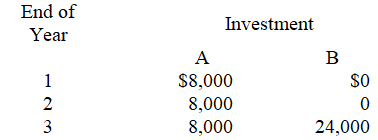

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments.The company is considering two different investments.Each require an initial investment of $15,000 and will produce cash flows as follows:

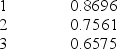

The present value factors of $1 each year at 15% are:

The present value of an annuity of $1 for 3 years at 15% is 2.2832

-The net present value of Investment B is:

Definitions:

Inventory

The total amount of goods a company has in stock, including raw materials, work-in-process, and finished goods.

Variable Costs

Expenses that change in proportion to the activity of a business, such as materials and labor costs.

Relevant Costs

Costs that will be affected by a decision in a particular situation, excluding sunk costs and costs that do not differ between alternatives.

Unprofitable Product Lines

Product categories or items that do not generate a profit and may result in a financial loss for the company.

Q28: Use the following data to find the

Q43: Costs already incurred in manufacturing the units

Q64: A minimum acceptable rate of return for

Q76: The payback method,unlike the net present value

Q86: A partnership that has at least two

Q125: The potential benefits lost by taking a

Q126: A partnership recorded the following journal entry:

Q154: The Mixed Nuts Division of Yummy Snacks,Inc.had

Q175: Define joint costs and explain how joint

Q205: The total amount of indirect factory expenses