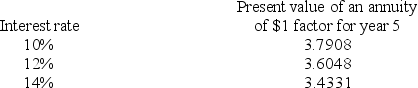

Tressor Company is considering a 5-year project.The company plans to invest $90,000 now and it forecasts cash flows for each year of $27,000.The company requires that investments yield a discount rate of at least 14%.Selected factors for a present value of an annuity of $1 for five years are shown below:  Calculate the internal rate of return to determine whether it should accept this project.

Calculate the internal rate of return to determine whether it should accept this project.

Definitions:

Physical Heights

The measurement of how tall or high something or someone is.

Regression Toward

This phrase often relates to "regression toward the mean," a statistical principle indicating that extreme or unusual outcomes tend to be followed by more typical ones.

Illusory Correlation

The cognitive bias of perceiving a relationship between variables (e.g., events, behaviors) even when no such relationship exists.

Biology Test

An examination intended to assess a person's knowledge or understanding of biological concepts and principles.

Q20: Identify the five steps involved in managerial

Q30: Bricktan Inc.makes three products,basic,classic,and deluxe.The maximum Bricktan

Q39: In accounting for noninfluential securities:<br>A)The GAAP concept

Q44: Define the partner return on equity ratio

Q49: A company has two departments,Y and Z

Q75: Force and Zabala are partners.Force's capital balance

Q78: A cost variance can be further separated

Q88: A report that accumulates the actual expenses

Q191: Georgia,Inc.has collected the following data on one

Q204: Sturdivant Fasteners,Co.uses a traditional allocation of overhead