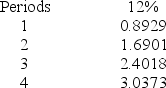

Butler Corporation is considering the purchase of new equipment costing $30,000.The projected annual after-tax net income from the equipment is $1,200,after deducting $10,000 for depreciation.The revenue is to be received at the end of each year.The machine has a useful life of 3 years and no salvage value.Butler requires a 12% return on its investments.The present value of an annuity of $1 for different periods follows:

-What is the net present value of the machine?

Definitions:

Mexican Treasury

Refers to the governmental department responsible for issuing Mexican government securities, including bonds and treasury bills.

Spot Exchange Rate

The current market price for immediate exchange of currencies.

British Securities

Financial instruments issued in the United Kingdom, including stocks, bonds, and other investment vehicles.

Total Return

The overall financial gain or loss on an investment, including both capital appreciation and income received.

Q33: A U.S.company's credit sale to an international

Q66: Three widely used methods of comparing investment

Q87: Pinkin Inc.needs to determine a price

Q97: When a partner invests in a partnership,his/her

Q97: Wheeler Company can produce a product that

Q114: A shorter payback period reduces the company's

Q136: A company is considering a 5-year project.The

Q140: Product A requires 5 machine hours per

Q141: If a U.S.company makes a credit sale

Q186: The concepts of direct expenses and uncontrollable