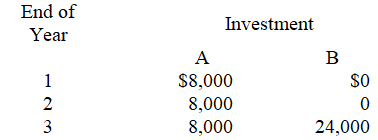

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments.The company is considering two different investments.Each require an initial investment of $15,000 and will produce cash flows as follows:

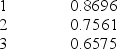

The present value factors of $1 each year at 15% are:

The present value of an annuity of $1 for 3 years at 15% is 2.2832

-Which investment should Alfarsi choose?

Definitions:

Placement of Ideas

The strategic organization of concepts or thoughts within a piece of writing or presentation to achieve desired effects or comprehension.

Key Points

The main or essential ideas, facts, or elements of a discussion or argument.

Active Voice

A sentence structure where the subject performs the action expressed by the verb, making the writing more direct and clear.

Important Ideas

Concepts or thoughts that hold significant value or influence within a certain context.

Q21: Short-term investments:<br>A)Are securities that management intends to

Q33: A company has the choice of either

Q36: A system of performance measures,including nonfinancial measures,used

Q52: A capital budgeting method that considers how

Q57: A U.S.company makes a sale to a

Q76: Significant sunk costs are relevant to decisions

Q85: Equity securities reflect a creditor relationship such

Q105: Logan Company can sell all of the

Q125: In closing the accounts at the end

Q194: A company provided the following direct materials