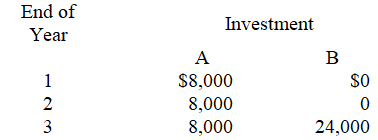

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments.The company is considering two different investments.Each require an initial investment of $15,000 and will produce cash flows as follows:

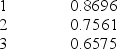

The present value factors of $1 each year at 15% are:

The present value of an annuity of $1 for 3 years at 15% is 2.2832

-The net present value of Investment A is:

Definitions:

Rate of Return

The positive or negative change in an investment's worth, calculated as a percentage of its original cost.

Correlation Coefficient

A numerical measure of the linear correlation between two variables, ranging from -1 to 1.

Riskless Portfolio

A theorized portfolio of investments that has a guaranteed return, with no risk of financial loss.

Risky Stocks

Shares in companies with high volatility and potential for substantial gains or losses.

Q3: Future value can be found if the

Q3: Two investments with exactly the same payback

Q5: Assuming Maxim further processes Green Health further

Q50: A _ helps control costs and expenses

Q78: The partnership shows the following capital balances

Q122: Chang Industries has 2,000 defective units of

Q139: Investments in debt and equity securities that

Q141: If a U.S.company makes a credit sale

Q152: A fixed budget is based on a

Q185: Two investment centers at Marshman Corporation have