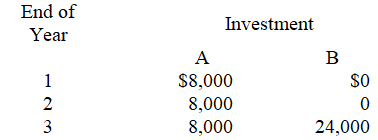

Alfarsi Industries uses the net present value method to make investment decisions and requires a 15% annual return on all investments.The company is considering two different investments.Each require an initial investment of $15,000 and will produce cash flows as follows:

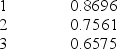

The present value factors of $1 each year at 15% are:

The present value of an annuity of $1 for 3 years at 15% is 2.2832

-The net present value of Investment B is:

Definitions:

Fixed Rates

Interest rates that remain constant over the lifetime of a financial instrument, unaffected by market fluctuations.

Floating Interest

An interest rate that changes over the life of a loan or mortgage, based on the current market conditions or an index.

Solvency

The ability of an entity to meet its long-term debts and financial obligations.

Times Interest Earned Ratio

A financial ratio that measures a company's ability to meet its debt obligations by comparing its income before interest and taxes to its interest expenses.

Q5: Mutual agency means each partner can commit

Q27: A granary allocates the cost of unprocessed

Q40: The future value of $100 compounded semiannually

Q96: The partnership shows the following capital balances

Q104: Granfield Company is considering eliminating its backpack

Q121: Bluebird Mfg.has received a special one-time order

Q121: Which of the following is not true

Q126: A partnership recorded the following journal entry:

Q131: A lumber mill bought a shipment of

Q138: Parallel Enterprises has collected the following data