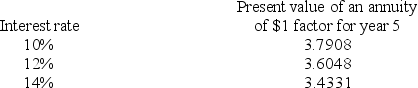

Tressor Company is considering a 5-year project.The company plans to invest $90,000 now and it forecasts cash flows for each year of $27,000.The company requires that investments yield a discount rate of at least 14%.Selected factors for a present value of an annuity of $1 for five years are shown below:  Calculate the internal rate of return to determine whether it should accept this project.

Calculate the internal rate of return to determine whether it should accept this project.

Definitions:

Computer Processors

The central component in a computer that performs the calculations and processing required to execute commands and run software.

Intel And Amd

Two leading semiconductor companies known primarily for manufacturing microprocessors and other related technology components.

Distribution

The process of making a product or service available for the consumer or business user who needs it.

Marketing Mix

The set of controllable marketing variables that a company uses to pursue its desired level of sales in the target market, traditionally defined as product, price, place, and promotion.

Q9: Investment center managers are evaluated on their

Q18: Holden,Phillips,and Rogers are partners with beginning-year capital

Q23: A company has net income of $250,000,net

Q27: Capital budgeting decisions are risky because all

Q47: A company paid $37,800 plus a broker's

Q57: Additional costs incurred if a company pursues

Q69: Standard costs are preset costs for delivering

Q80: _ means that partners can commit or

Q121: Mutual agency means<br>A)Creditors can apply their claims

Q127: The equity section of the balance sheet