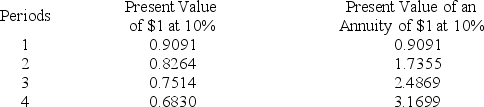

Poe Company is considering the purchase of new equipment costing $80,000.The projected annual cash inflows are $30,200,to be received at the end of each year.The machine has a useful life of 4 years and no salvage value.Poe requires a 10% return on its investments.The present value of $1 and present value of an annuity of $1 for different periods is presented below.

-Compute the net present value of the machine.

Definitions:

Private Capital

Funds or assets owned by individuals, companies, or investors, not by the government or public entities.

World Bank

An international lending institution that offers financial aid and grants to the governments of developing countries for capital project initiatives.

Economic Growth

An increase in the production of goods and services in an economy over a period of time, typically measured by the rise in real GDP.

Developing Countries

Nations with a lower standard of living, underdeveloped industrial base, and lower Human Development Index (HDI) compared to developed countries.

Q49: A(n)_ requires a future outlay of cash

Q64: A college uses advisors who work with

Q70: The salaries of employees who spend all

Q127: The capital budgeting process involves all of

Q137: Coffer Co.is analyzing two potential investments. <img

Q146: If a company owns more than 20%

Q159: On September 1,2014,Rode Corp.paid $100,000 plus a

Q161: Standard material costs,standard labor costs,and standard overhead

Q181: On January 1,2014,Newark Corp.paid $60,000 plus a

Q186: Management by exception means that managers focus