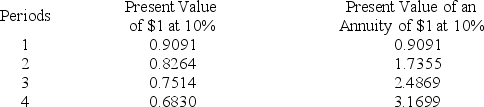

Poe Company is considering the purchase of new equipment costing $80,000.The projected annual cash inflows are $30,200,to be received at the end of each year.The machine has a useful life of 4 years and no salvage value.Poe requires a 10% return on its investments.The present value of $1 and present value of an annuity of $1 for different periods is presented below.

-Compute the net present value of the machine.

Definitions:

Wage Paid

The amount of money that employers pay to employees for their labor or services within a given time period.

Workers

Individuals employed by others or self-employed, contributing labor to produce goods or provide services.

Human Capital

The sum of abilities, expertise, and learned information that an individual or group has, considered in relation to its worth or expense for a company or nation.

Profit Maximization

The method through which a company identifies the pricing and production quantity that yields the highest profit.

Q7: Direct expenses require allocation across departments because

Q16: A capital deficiency means that:<br>A)The partnership has

Q23: Hassock Corp.produces woven wall hangings.It takes 2

Q39: Division P of Launch Corporation has the

Q63: A partnership designed to protect innocent partners

Q100: The total cost of operating the Milling

Q109: In a limited partnership the general partner

Q136: Kramer Corporation had the following long-term investment

Q145: Bannister Co.is thinking about having one

Q197: Division X makes a part that it