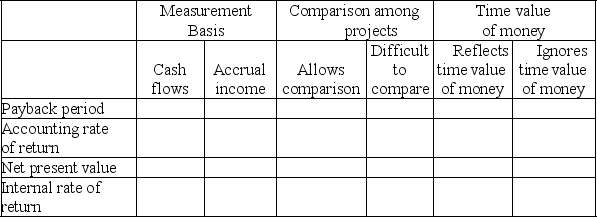

For each of the capital budgeting methods listed below,place an X in the correct column,indicating the measurement basis of each,the ability to make comparison among projects,and whether each method reflects or ignores the time value of money.

Definitions:

Consumption Taxes

Taxes imposed on spending on goods and services, such as sales tax or Value Added Tax (VAT).

Average Tax Rate

The percentage of gross income that goes towards tax payments, determined by dividing the sum of taxes paid by the gross income.

Taxable Income

The amount of income used to calculate how much the government can tax an individual or a corporation.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the impact of additional income on tax liability.

Q17: A company borrows money from the bank

Q21: In regard to joint cost allocation,the "split-off

Q26: Shale Remodeling uses time and materials pricing.It

Q32: What is the amount of incremental income

Q49: An _ is a series of equal

Q77: J&H Company has a router platform with

Q83: Direct expenses are costs readily traced to

Q92: A partnership agreement:<br>A)Is not binding unless it

Q126: A company provided the following direct materials

Q175: A company had net income of $2,785,000,net