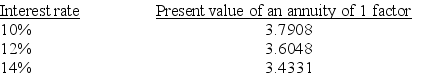

A company is considering a 5-year project.It plans to invest $62,000 now and it forecasts cash flows for each year of $16,200.The company requires a hurdle rate of 12%.Calculate the internal rate of return to determine whether it should accept this project.Selected factors for a present value of an annuity of 1 for five years are shown below:

Definitions:

Undress

To remove clothing, often for the purpose of examination, treatment, or changing into a patient gown in a medical context.

Peripheral Neuropathy

A condition resulting from damage to the peripheral nerves, characterized by weakness, numbness, and pain, typically in the hands and feet.

Peripheral Vascular Disease

A circulatory condition characterized by narrowed blood vessels outside of the heart and brain, often leading to reduced blood flow to the limbs.

Foot Problems

Various conditions affecting the feet, including fungal infections, ingrown toenails, and plantar fasciitis.

Q16: Explain how held-to-maturity debt securities are accounted

Q38: Groh and Jackson are partners.Groh's capital balance

Q44: The present value factor for determining the

Q57: Identify at least three reasons for managers

Q63: For projects financed from borrowed funds,the hurdle

Q90: Galla Inc.operates in a highly competitive

Q94: A machine costs $180,000 and will have

Q132: The BlueFin Partnership agrees to dissolve.The cash

Q133: The internal rate of return method is

Q167: On January 2,2014,Palmer Corp.paid $500,000 cash to