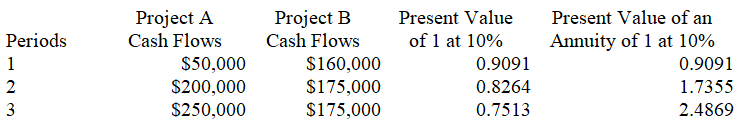

Trevoline Company is deciding between two projects.Each project requires an initial investment of $350,000.The projected net cash flows for the two projects are listed below.The revenue is to be received at the end of each year.Trevoline requires a 10% return on its investments.The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below.Use net present value to determine which project should be pursued and explain why.

Definitions:

Consolidated Net Income

The combined net income of a parent company and its subsidiaries, factoring in the effects of intercompany transactions.

Equity Method

An accounting technique used for recording investments in associate companies where the investment is initially recorded at cost and subsequently adjusted for the investor’s share of the net profits or losses of the investee.

Consolidation Worksheet Entries

Journal entries used in preparing consolidated financial statements, helping to adjust and eliminate internal transactions between parent and subsidiary entities.

Fair Value

An estimate of the price at which an asset or liability could be exchanged in a current transaction between willing parties.

Q23: Hassock Corp.produces woven wall hangings.It takes 2

Q63: A partnership designed to protect innocent partners

Q70: Chen and Wright are forming a partnership.Chen

Q89: A company is considering purchasing a machine

Q100: Derby Inc.manufactures a product which contains

Q128: The Linens Department of the Krafton Department

Q129: Joint costs can be allocated either using

Q147: An advantage of the break-even time (BET)method

Q159: Williams Co.operates three separate departments (R,S,T).The data

Q200: A retail store has three departments,A,B,and C,each