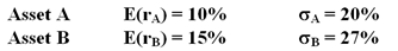

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%:  An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

Definitions:

Gene Duplication

A process in which a segment of genetic material or a whole gene is copied or duplicated, leading to multiple copies of that segment or gene in the genome.

Paralogs

Genes that arise by duplication within the same organism, often developing new functions while retaining some characteristics of the original gene.

Functional Redundancy

The phenomenon where multiple species or genes perform similar functions within an ecosystem or biological system, providing resilience against environmental changes or perturbations.

Engrailed Gene

A gene that plays a crucial role in defining the segments and patterning of the body parts in many organisms, including their limb development.

Q3: You purchased XYZ share at $50 per

Q21: According to technical analysts, a shift in

Q27: In an efficient market and for an

Q33: When assessing sustainability of a firm's cash

Q36: Financial assets represent _ of total assets

Q42: Carter's share of a partnership's operating loss

Q42: When bonds sell above par, what is

Q43: Which one of the following measures time-weighted

Q46: Which of the following is not an

Q89: Matthew earned $150,000 in wages during 2017.FICA