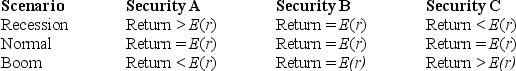

Based on the outcomes in the following table, choose which of the statements below is (are) correct?

I. The covariance of security A and security B is zero.

II. The correlation coefficient between securities A and C is negative.

III. The correlation coefficient between securities B and C is positive.

Definitions:

Cost-to-Retail Ratio

The cost-to-retail ratio is a calculation used in inventory management to estimate the value of ending inventory at retail prices by considering the cost and retail value of goods available for sale.

Estimated Cost

An approximation of the costs associated with a project or production, prior to actual expenditure.

Lower of Cost or Market (LCM)

Lower of Cost or Market (LCM) is an accounting principle requiring inventory to be recorded at the lower of its historical cost or current market value to reflect any decrease in the value of inventory.

Ending Inventory Costs

The total value of all the goods that a company has in stock at the end of an accounting period, before any adjustments or cost of goods sold calculations.

Q8: _ funds stand ready to redeem or

Q31: If the nominal rate of return on

Q34: In an era of particularly low interest

Q37: Moving to higher-yield bonds, usually with longer

Q37: In his 1970 study, Malkiel found that

Q39: Which of the following is not a

Q43: The difference between the price at which

Q47: An investor buys a T-bill at a

Q59: A bond portfolio manager notices a hump

Q60: You run a regression for a stock's