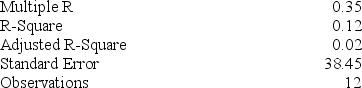

You run a regression for a stock's return on a market index and find the following Excel output:

This stock has greater systematic risk than a stock with a beta of ________.

Definitions:

Kraiger

A reference to Kurt Kraiger, a psychologist known for his work on training effectiveness and evaluation.

Cognitive Outcomes

The results of intellectual processes, including learning, understanding, and applying knowledge and skills.

Skill-Based Outcomes

The specific skills and abilities that participants are expected to acquire as a result of participating in a training program or educational course.

Affective Outcomes

Results relating to changes in feelings, attitudes, or emotional areas of an individual after undergoing a training or learning process.

Q2: Which measure of downside risk predicts the

Q19: Trading on inside information is:<br>I. Prohibited by

Q42: During a period when prices have been

Q44: Commercial paper is a short-term security issued

Q45: The formula <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6474/.jpg" alt="The formula

Q61: "Active investment management may at times generate

Q67: A zero-coupon bond has a yield to

Q76: Published data on past returns earned by

Q85: When the market risk premium rises, stock

Q96: A coupon bond that pays interest of