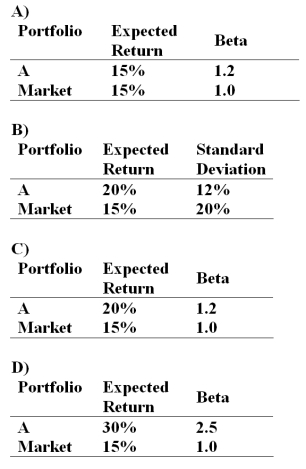

If the simple CAPM is valid and all portfolios are priced correctly,which of the situations below are possible? Consider each situation independently and assume the risk free rate is 5%.

Definitions:

Debt Ratio

Debt divided by total assets. A financial ratio measuring the degree to which the firm uses borrowed money.

Total Debt

The sum of all liabilities, both current and long-term, that a company owes to external parties.

Net Worth

The total assets minus total liabilities of an individual or company, indicating financial health and stability.

Operating Income

Earnings before interest and taxes (EBIT), representing the profit a company makes after paying for variable costs of production but before paying interest or tax.

Q4: The decline in the value of the

Q25: A bond portfolio manager notices a hump

Q29: Joe bought a stock at $57 per

Q30: Which of the following is not a

Q35: Large well-known companies often issue their own

Q61: On a particular day,there were 920 stocks

Q73: A T-bill quote sheet has 90 day

Q73: Characteristics _ would be typical of an

Q82: Which of the following correlations coefficients will

Q84: The greatest percentage of mutual fund assets