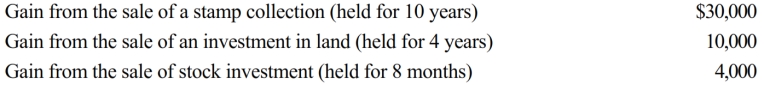

Perry is in the 32% tax bracket. During 2018, he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

Definitions:

Rule-Of-Reason Analysis

A legal principle used in antitrust law that evaluates the reasonableness of a restrictive business practice based on its circumstances, purpose, and effect on competition, rather than deeming it illegal per se.

Quick-Look Analysis

A preliminary, expedited evaluation of a situation or set of data to gain an initial understanding and guide further in-depth analysis.

California Dental Association

A nonprofit organization representing the dental profession in California, dedicated to advancing the profession through education, advocacy, and member services.

Clayton Act

A U.S. antitrust law enacted in 1914 to promote competition and prevent unfair business practices in the marketplace.

Q25: Alvin is the sole shareholder of an

Q29: April, a calendar year taxpayer, is a

Q36: A loss is not allowed for a

Q42: Multiple support agreement

Q47: Married taxpayers who file separately cannot later

Q67: Which Regulations have the force and effect

Q86: Subchapter D refers to the "Corporate Distributions

Q89: Which of the following taxpayers may file

Q104: In December 2018, Todd, a cash basis

Q211: The proposed flat tax:<br>A) Would increase the