Multiple Choice

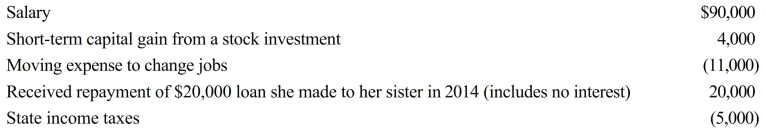

In 2018, Nai-Yu had the following transactions:

Nai-Yu's AGI is:

Definitions:

Related Questions

Q2: Bob and April own a house at

Q8: Carmen had worked for Sparrow Corporation for

Q14: Desired consumption is Cd = 2000 +

Q19: An employee can exclude from gross income

Q23: Zork Corporation was very profitable and had

Q50: A nephew who lives with taxpayer.

Q52: Ralph purchased his first Series EE bond

Q72: On January 5, 2018, Tim purchased a

Q79: The tax law allows an income tax

Q207: Which, if any, of the following transactions