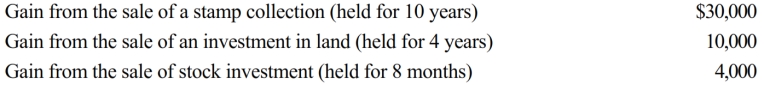

Perry is in the 32% tax bracket. During 2018, he had the following capital asset transactions:

Perry's tax consequences from these gains are as follows:

Definitions:

Project's Risk

The potential for losses or less-than-expected returns from a specific investment or business project.

Risk

The potential for losing something of value, often measured by the variability of returns associated with an investment.

Cash Flow Estimating

The process of projecting the future cash inflows and outflows of a project or company to determine its financial health.

Capital Budgeting

The process businesses use to evaluate potential major projects or investments.

Q20: Debbie is age 67 and unmarried and

Q21: An increase in expected inflation causes the

Q49: During 2018, Lisa (age 66) furnished more

Q52: A "Bluebook" is substantial authority for purposes

Q60: Which, if any, of the following statements

Q64: Abandoned spouse

Q67: The IRS agent auditing the return will

Q80: How do treaties fit within tax sources?

Q81: A decline in the price of a

Q189: Stealth taxes have the effect of generating