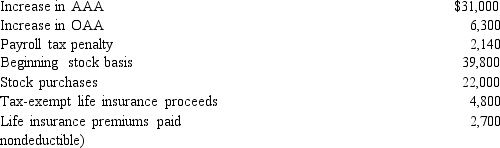

You are given the following facts about a solely owned S corporation.What is the shareholder's ending stock basis?

Definitions:

Operating Income

This refers to the profit realized from a business's operations, calculated by subtracting operating expenses from gross profit.

Sales Price

The amount that a customer pays to purchase a good or service from a business.

Variable Costs

Expenses that fluctuate with the level of output, including costs such as raw materials and labor.

Fixed Costs

Expenses that do not change with the level of production or sales.

Q28: When it liquidates, a partnership is not

Q32: Meg's employer carries insurance on its employees

Q45: In 2018, Brenda has calculated her regular

Q74: Business tax credits reduce the AMT and

Q78: Robin Corporation, a calendar year taxpayer, has

Q96: ForCo, a non-U.S.corporation based in Aldonza, purchases

Q104: Thrush, Inc., is a calendar year, accrual

Q109: Adam repairs power lines for the Egret

Q112: Rachel owns 100% of the stock of

Q189: Which of the following is not part