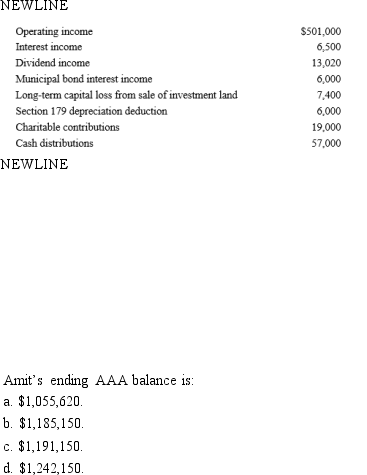

Amit, Inc., an S corporation, holds an AAA balance of $614,000 at the beginning of the tax year.During the year, the following items occur.

E)Some other amount.

Definitions:

Asperger Syndrome

A developmental disorder characterized by significant difficulties in social interaction and nonverbal communication, along with restricted and repetitive patterns of behavior and interests.

Social Deprivation

The lack of socially normal interaction, communication, and engagement with others, leading to adverse effects on development and well-being.

Infantile Amnesia

The inability of adults to recall personal experiences from their early childhood.

Egocentrism

A cognitive bias that causes individuals to view the world solely from their own perspective, often neglecting others' viewpoints.

Q17: Cardinal Company incurs $800,000 during the year

Q18: Regular tax rate<br>A)For the corporate taxpayer, are

Q19: A benefit of an S corporation when

Q24: An increase in the LIFO recapture amount

Q27: During the year, Green, Inc., incurs the

Q78: The exclusion for health insurance premiums paid

Q81: Carol is self-employed and uses her automobile

Q89: The partnership agreement might provide, for example,

Q112: Shareholders owning an) of shares voting and

Q128: In the apportionment formula, most states assign