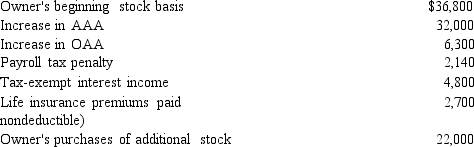

You are given the following facts about a 40% owner of an S corporation, and you are asked to prepare her ending stock basis.

Definitions:

Salaries Expense

An expense account recording the total amount paid to employees for services rendered during a specific period.

Freight-in

Costs associated with transporting inventory to the company, which are typically added to the cost of inventory.

Post-Closing Trial Balance

The final step in the accounting cycle that lists only permanent accounts in the ledger and their balances after adjusting and closing entries have been posted.

Income Statement

A financial report detailing a company's revenues, expenses, and profits or losses over a specific period, demonstrating financial performance.

Q3: A sole proprietorship files Schedule C of

Q8: Abby is a limited partner in a

Q10: The components of the general business credit

Q35: Tungsten Corporation, a calendar year cash basis

Q48: Arnold purchases a building for $750,000 which

Q56: Business interest<br>A)Organizational choice of many large accounting

Q76: Jake, the sole shareholder of Peach Corporation,

Q90: Additional first-year bonus) depreciation deduction claimed in

Q112: Rachel owns 100% of the stock of

Q157: International standards are developed by the<br>A) IFRS.<br>B)