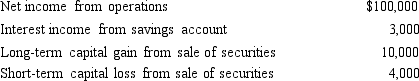

Oxen Corporation incurs the following transactions.  Oxen maintains a valid S election and does not distribute any assets cash or property) to its sole shareholder, Megan.As a result, Megan must recognize ignore 20% QBI deduction) :

Oxen maintains a valid S election and does not distribute any assets cash or property) to its sole shareholder, Megan.As a result, Megan must recognize ignore 20% QBI deduction) :

Definitions:

Household Members

Individuals who reside in the same dwelling, sharing living accommodations and possibly familial or economic ties.

Seller's Warranties

Guarantees made by a seller regarding the condition, quality, or performance of a product.

Implied Warranty of Merchantability

A legal assurance that goods sold meet minimum quality standards and are fit for the purpose sold.

Trade Usage

Established practices or patterns of behavior regularly observed and accepted in a particular industry.

Q12: Katherine, the sole shareholder of Penguin Corporation,

Q15: If a transaction qualifies under § 351,

Q18: Akeem, who does not itemize, incurred a

Q30: Which of the following statements concerning capital

Q51: Paul incurred circulation expenditures of $180,000 in

Q53: BRW Partnership reported gross income from operations

Q85: A former spouse is treated as being

Q88: An S shareholder's stock basis can be

Q110: A cash basis calendar year C corporation

Q114: The Code treats corporate distributions that are