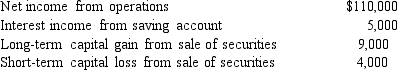

Lemon Corporation incurs the following transactions.  Lemon maintains a valid S election and does not distribute any dividends to its shareholder, Patty.As a result, Patty must recognize ignore the 20% QBI deduction) :

Lemon maintains a valid S election and does not distribute any dividends to its shareholder, Patty.As a result, Patty must recognize ignore the 20% QBI deduction) :

Definitions:

Income Earns

The compensation received by an individual or generated by an entity in exchange for labor or services or as earnings from investments.

Afford

The financial capacity to purchase something, indicating that the cost does not exceed the buyer’s purchasing power or budget constraints.

Optimum Purchasing

The process of buying goods and services in the most efficient and cost-effective manner, maximizing value for the purchaser.

Sweaters

Garments intended for upper body warmth, traditionally made from wool but now also from synthetic fibers.

Q3: Every year, Teal Corporation gives each employee

Q19: Amy lives and works in St.Louis.In the

Q36: A worker may prefer to be treated

Q39: A partner will have the same profit-sharing,

Q77: On January 1 of the current year,

Q77: In computing the property factor, property owned

Q78: Federal general business credit.<br>A)Addition modification<br>B)Subtraction modification<br>C)No modification

Q79: Chipper Corporation realized $1,000,000 taxable income from

Q120: Typically, sales/use taxes constitute about 20 percent

Q132: Durell's sole proprietorship builds residential housing.The business