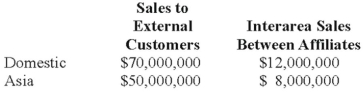

Collins Company reported consolidated revenue of $120,000,000 in 20X8. Collins operates in two geographic areas, domestic and Asia. The following information pertains to these two areas:  What calculation below is correct to determine if the revenue test is satisfied for the Asian operations?

What calculation below is correct to determine if the revenue test is satisfied for the Asian operations?

Definitions:

Fixed Manufacturing Overhead

Costs that do not vary with the level of production or sales, such as rent, property taxes, and salaries of permanent employees.

Variable Manufacturing Overhead

Costs of manufacturing that fluctuate with the level of production, such as utilities or commissions, excluding direct materials and direct labor.

Fixed Manufacturing Overhead

Indirect production costs that remain constant, regardless of the level of production output, such as salaries or rent.

Direct Labor-Hours

An accounting metric denoting the hours worked by employees directly involved in manufacturing goods or providing services, crucial for cost allocation and pricing.

Q8: At the end of the year, a

Q14: Blue Corporation holds 70 percent of Black

Q20: Lemon Corporation acquired 80 percent of Bricks

Q42: On December 1, 20X8, Merry Corporation acquired

Q43: Tower Corporation's controller has just finished preparing

Q53: Agency funds report:<br>A) only assets and liabilities.<br>B)

Q66: The general fund of the Town of

Q68: The perspective that views society as a

Q79: On January 1, 20X1, Washington City received

Q101: Private Not-For-Profit (NFP) Entities.<br>Select from this list