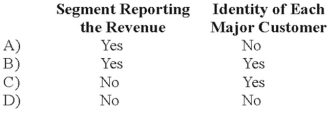

Stone Company reported $100,000,000 of revenues on its 20X8 income statement. During the year ended December 31, 20X8, Stone made sales of $8,000,000 to external customers in Western Europe. In addition, Stone made sales of $10,000,000 to the U.S. government and $4,000,000 of sales to various state governments. In the footnotes to its financial statements for 20X8, in reporting enterprisewide disclosures, Stone is required to disclose:

Definitions:

Total Assets

The sum of all current and non-current assets owned by a company, representing its total economic value.

Net Income

The net income of a company, which is calculated by deducting all expenses, taxes, and costs from its total revenue.

Unrecorded Revenues

Earnings generated from business activities that have not yet been documented in the financial accounts.

Adjusting Process

A procedure in accounting to update ledger accounts for accruals, deferrals, prepayments, and estimates so financial statements are accurate.

Q26: Secondary groups are more commonly found in<br>A)

Q27: The transactions described in the following questions

Q28: All assets and liabilities are transferred to

Q30: If the functional currency is the local

Q30: On January 1, 20X7, Pisa Company acquired

Q38: In a university, class cancellation refunds of

Q39: Heavy Company sold metal scrap to a

Q42: The BIG Partnership has decided to liquidate

Q50: Spiralling crude oil prices prompted AMAR Company

Q61: Feminist theory suggests that_ differences shape our