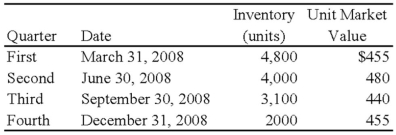

Forge Company, a calendar-year entity, had 6,000 units in its beginning inventory for 20X8. On December 31, 20X7, the units had been adjusted down to $470 per unit from an actual cost of $510 per unit. It was the lower of cost or market. No additional units were purchased during 20X8. The following additional information is provided for 20X8:  Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Forge does not have sufficient experience with the seasonal market for its inventory units and assumes that any reductions in market value during the year will be permanent.

Based on the preceding information, the cost of goods sold for the second quarter is:

Definitions:

Lump Sum

An amount of money paid in a single payment, rather than in installments.

11% Return

A specific rate of return on an investment, denoting a gain of eleven percent on the original amount invested.

Annual Interest Rate

The percentage of interest that is charged or earned on an investment or loan over a one-year period.

Down Payment

An initial payment made when purchasing an item on credit, particularly real estate, often expressed as a percentage of the purchase price.

Q5: Mortar Corporation acquired 80 percent of Granite

Q6: All assets and liabilities are transferred to

Q8: Stone Company reported $100,000,000 of revenues on

Q8: Peter Architectural Services owns 100 percent of

Q24: For which of the following funds are

Q39: Heavy Company sold metal scrap to a

Q42: The SEC administers many laws and regulations

Q45: Any intercompany gain or loss on a

Q52: All of the following situations require a

Q83: _is Max Weberʹs term for the subjective