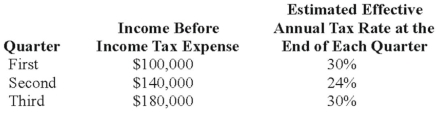

Denver Company, a calendar-year corporation, had the following actual income before income tax expense and estimated effective annual income tax rates for the first three quarters in 20X8:  Denver's income tax expense in its interim income statement for the third quarter should be:

Denver's income tax expense in its interim income statement for the third quarter should be:

Definitions:

Market Prices

The current price at which a good or service can be bought or sold in a marketplace, determined by supply and demand dynamics.

Income Source

The origin or means through which an individual, company, or entity earns money.

Utility Function

An expression that captures how a consumer ranks different bundles of goods based on the level of utility or satisfaction each bundle provides.

Labor Income

Earnings from work or employment, including wages, salaries, bonuses, and any other form of payment for labor services.

Q2: During the fiscal year ended June 30,

Q8: The transactions listed in the following questions

Q16: For a subsidiary to be eligible to

Q18: Samuel Corporation foresees a downturn in its

Q22: All of the following are true statements

Q28: Note: This is a Kaplan CPA Review

Q32: Dividends of a foreign subsidiary are translated

Q50: Which combination of accounts and exchange rates

Q60: The general fund of Sun City was

Q65: According to symbolic interactionists,<br>A) people respond directly