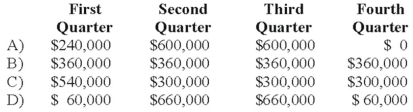

Mason Company paid its annual property taxes of $240,000 on February 15, 20X9. Mason also anticipates that its annual repairs expense for 20X9 will be $1,200,000. This amount is usually incurred and paid in July and August when operations are shut down so that machinery and equipment can be repaired. What amount should Mason deduct for property taxes and repairs in each quarter for 20X9?

Definitions:

Person Analysis

The process of assessing an individual's capabilities, skills, and developmental needs to optimize job performance.

Interpersonal Communication Skills

The abilities used to effectively exchange information, ideas, and feelings with others through verbal, non-verbal, written, and digital channels.

Conflicts

Disagreements or disputes arising from differences in attitudes, beliefs, values, or needs among individuals or groups.

Instructional Design Process

A systematic approach to creating educational and training programs in a consistent and reliable fashion to improve learning and efficiency.

Q8: A scientific theory is<br>A) beyond the research

Q8: Peter Architectural Services owns 100 percent of

Q9: Toledo Imports, a calendar-year corporation, had the

Q14: As of May 30, 20X9, the debt

Q14: Lemon Corporation acquired 80 percent of Bricks

Q15: Mortar Corporation acquired 80 percent of Granite

Q20: The transactions described in the following questions

Q30: A personal statement of financial condition dated

Q60: The town of Decorah issued general obligation

Q67: The general fund of Loveland ordered a