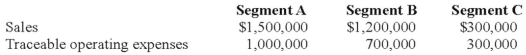

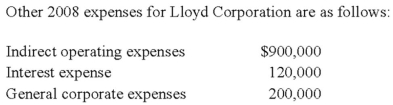

Lloyd Corporation reports the following information for 20X8 for its three operating segments:

Indirect operating expenses are allocated to segments based upon the ratio of each segment's traceable operating expenses to total traceable operating expenses. Interest expense is allocated to segments based upon the ratio of each segment's sales to total sales.

Required:

a) Calculate the operating profit or loss for each of the segments for 20X8.

b) Determine which segments are reportable, applying the operating profit or loss test.

Definitions:

Sales Tax

A tax imposed by government authorities on the sale of goods and services, paid for by the consumer at the point of purchase.

Sales Tax

A tax levied by a government on the sale of goods and services, usually calculated as a percentage of the purchase price.

Sales Tax

A government-imposed tax on the sale of goods and services, collected by retailers at the point of sale.

Tax Rate

The percentage at which an individual or corporation is taxed by the government on income or property.

Q4: Mortar Corporation acquired 80 percent of Granite

Q6: During the fiscal year ended June 30,

Q6: Tower Corporation's controller has just finished preparing

Q11: All of the following describe the International

Q15: On December 31, 20X7, Planet Corporation acquired

Q15: Mortar Corporation acquired 80 percent of Granite

Q22: Master Corporation owns 85 percent of Servant

Q41: A method of observation in which the

Q42: Gotham City acquires $25,000 of inventory on

Q58: When is a partnership considered to be