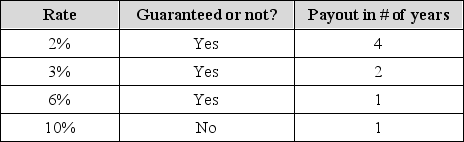

An investor is faced with a decision of investing $5,000. The investor is in no hurry to cash in on their gains and is considered risk-averse. Which option should they choose?

Definitions:

Havana

The capital city, major port, and leading commercial center of Cuba, known for its historical buildings, vibrant culture, and significant role in the Caribbean region.

Rising Power

Refers to a nation or entity that is becoming increasingly influential and strong in economic, political, or military terms on the global stage.

Open Door Policy

Demand in 1899 by Secretary of State John Hay, in hopes of protecting the Chinese market for U.S. exports, that Chinese trade be open to all nations.

Investment Opportunities

Prospects or options to invest capital with the potential to generate a return.

Q5: A "conflict of interest" arises when a

Q7: The critical point of ammonia, NH<sub>3</sub>, occurs

Q11: Give some examples of the role that

Q24: The general strategy of most arguments against

Q24: Which of the following is an advantage

Q27: What is and what ought to be

Q28: _ is/are required for any evolutionary response,

Q30: Ricin is a protein that comes from

Q31: Without the greenhouse effect, the atmosphere around

Q36: Which of the following have removed limits